From the software user who doesn’t renew their subscription to the gym-goer who cancels their membership; these are the customers who have decided to stop conducting business with your company. This loss of business is known as customer churn. In this article, we’ll look at the many factors behind why customers churn and what steps you can take to reduce it. We will also look at calculating your churn rate and how that rate should be considered in other contexts to gain a more accurate picture.

Why do you need to understand customer churn?

In today’s world of digitalisation and crowded marketplaces, it’s easier than ever for customers to make comparisons. Then, they can choose their best option from a wide array of providers. Companies, therefore, face the challenge of not only convincing customers to choose them in the first place, but also retaining their existing customers once they get them.

In this article

Acquiring a new customer costs five times more than retaining an existing one. This alone shows why tracking—and managing—customer churn is so important. Focusing on long-term relationships and observing customer behaviour is more profitable than spending a lot of money on marketing and campaigns to attract new customers. Churn is important because it affects your company’s profitability. Also, the more you learn about your customers and their behaviour, the better understanding you’ll gain of future expected revenue.

What causes customer churn?

Understanding why customers leave is important when it comes to managing customer churn. Only by knowing the causes can you develop a clear strategy to tackle it. So let’s take a look at some of the most common reasons:

Poor customer service

This is one of the most significant factors behind customer churn. Customer buying behaviours are influenced heavily by customer service experiences, with 70% of people choosing to stop buying from a business due to poor service. Furthermore, 52% of dissatisfied customers would actively recommend others against conducting business with you, creating a slippery slope of lost opportunities.

Nonexistent or failed onboarding

Onboarding isn’t just for new employees joining a company. Customers should feel confident using your product or service and the value of it should be communicated early. Welcome emails, product tutorials, documentation, and phone support, all work together to form a successful onboarding experience. A lack of guidance can leave customers feeling over—or under—whelmed, causing them to abandon your product or service.

Lack of perceived value

Customers need to feel that they are getting good value. Pricing plays a significant role in this, with the market rejecting offerings where cost doesn’t match expectations. Or perhaps a competitor has a significantly better deal. Furthermore, perceived value is lost if there isn’t a clear sense of how a product or service is beneficial to the buyer. Considered in relation to our previous point. You should always ensure that every customer has a solid onboarding experience and is enlightened to the ways your offering is the perfect solution to their needs.

What do you customers value? Try Netigate free for 30 days.

Poor market fit

Successful companies continually monitor and work with their markets in order to ensure that their product or service develops to meet changing needs. In today’s busy marketplace, the company that falls behind will lose customers to the competitor who is looking ahead. To learn more about staying ahead in your market, read our article on the importance of market research here.

Involuntary churn

A common problem for subscription-based business models, involuntary churn occurs when a customer’s automated payment fails. Whether it’s out-of-date billing information or expired cards. This type of churn isn’t the result of a negative experience or issues with the service being offered. Involuntary churn is often overlooked, but it is is one of the most insidious factors, causing significant damage in the long run. In order to increase customer retention, it needs to be tackled as aggressively as voluntary churn.

Desired outcomes achieved a.k.a. Positive churn

Not all churn is bad. In some industries, like health care or online dating, it’s a sign of a job well done. Take a dating agency, for example. The ultimate goal of this kind of service is to help clients find love and live happily ever after. As a result, success in these scenarios means cancelled subscriptions, closed accounts, and the sound of wedding bells in the distance.

How to calculate your customer churn rate

Often expressed as a percentage, your customer churn rate is a measure of customer losses across a defined period of time. In an ideal world, your business would experience perfect customer retention with a 0% churn rate. In reality, every business will lose customers, and it’s important to track, manage, and analyse these losses closely.

Your churn rate can be measured by month, quarter, or year, with different industries preferring different time frames. Annual tracking is used across many industries, but Software as a Service (SaaS) companies and other subscription-based businesses will often measure their churn rate each month.

Before you get started, you need to ensure that your company has a clear policy in place to indicate when a customer is considered churned. For example, a customer’s auto-renewal has failed, but they also haven’t been in touch to explicitly cancel their subscription. Are they active or lost? You should remove all ambiguity before calculating your churn rate.

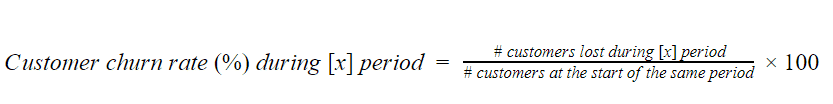

Customer churn rate

Customer churn rate (%) during [x] period = # customers lost during [x] period# customers at the start of the same period100

To determine your churn rate percentage, you must first identify the number of customers lost in your selected period (e.g. a month). To do this, simply start with the number of customers you had at the beginning of the period, and then detract the number you had at the end. Next, you divide the number of customers lost by the number of customers at the beginning of the same period, before multiplying by 100. The resulting number is your churn rate percentage. For example:

Company A started November with 110 customers and ended with 108. They lost 2 customers. They must then divide 2 by 110 (0.01) before multiplying it by 100 (1.8). Company A’s churn rate percentage for November is 1.8%.

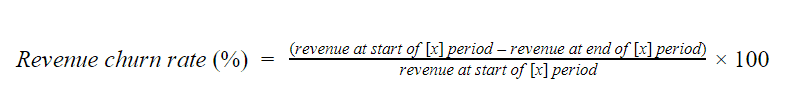

Revenue churn rate

Revenue churn rate (%) = (revenue at start of [x] period – revenue at end of [x] period)revenue at start of [x] period100

Every time a customer is lost, you are losing the revenue that they generate. As a result, this metric is arguably more important than your customer churn % alone because it highlights the impact of churn on the financial health of the business. The amount of revenue each customer brings in can vary depending on the amount they buy or their subscription type. If revenue churn isn’t carefully considered, you could be lulled into a false sense of security.

Let’s look at Company A again. They see £10,000 revenue at the beginning of November and £9,000 at the end (upgrades and expansions not included), leaving them with £1,000 churned. Following the above calculation, they then divide £1,000 by £10,000 before multiplying it by 100. Their revenue churn percentage is 10%. Unfortunately for Company A, the two customers they lost in November subscribed to their most premium package, so their relatively manageable churn rate of 1.8% was not giving them the full picture. This demonstrates the importance of considering customer churn from a number of different perspectives, so that you can take appropriate action.

Copyright © 2024 Netigate AB, Drottninggatan 25, 111 51, Stockholm, Sverige

Copyright © 2024 Netigate AB, Drottninggatan 25, 111 51, Stockholm, Sverige