One of the best ways to assess customers’ feelings about your business, products, and brands is to create customer surveys to gather feedback. Pitching them correctly helps you gather the necessary data to help you understand what you’re doing well and where you need to improve and drive actionable insights to help you fulfill your customers’ needs.

This article explains how to create customer surveys, structure them to gain the most actionable insights, and use the data you receive to improve your CX operations.

Understanding Customer Surveys

Research by Bain & Co. in 2005 found that 80% of CEOs believed they delivered a superior customer experience, with only 8% of their customers agreeing. Businesses that offer a genuinely outstanding business experience can see an 80% increase in revenue and deliver 60% higher profits than companies that don’t focus on CX.

With this, we can say that customer surveys play a significant role in bridging the gap between perception and reality, helping businesses gain actionable insights into customer needs and expectations, and ultimately driving improved customer experiences, higher satisfaction, and increased revenue.

Here are other ways surveys can help improve CX:

- Identify and fix product flaws

- Understand and improve customer satisfaction score

- Improve customer loyalty

- Increase revenue

- Understand customer sentiment – would customers recommend your brand?

Different Types of Customer Surveys

Customer surveys can teach you a lot. Online software tools allow your business to seamlessly interact with customers while measuring and analyzing responses to create actionable insights that improve customer experience.

Gaining the correct data to take these actions depends on asking the right questions. To ask the right questions, you must understand your CX objectives and create a customer feedback strategy that meets these goals. Here are some of the primary metrics businesses use to measure the customer experience through customer feedback surveys:

Customer Satisfaction Score (CSAT)

The Customer Satisfaction Score (CSAT) measures your customers’ satisfaction with your company. A CSAT survey is usually a simple question to customers after they’ve purchased or interacted with your business to assess how happy they are with your products, services, and work.

Net Promoter Score (NPS)

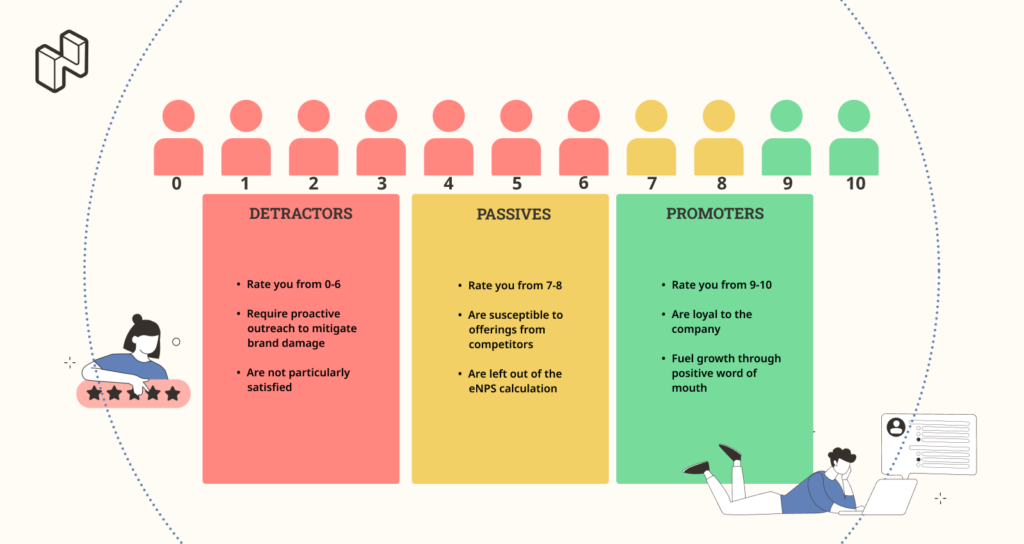

Meanwhile, the Net Promoter Score (NPS) measures whether customers will advocate for your business, recommend you to friends, families, and colleagues, or promote you online. Customers are asked to rank their business on a scale of 1 to 10, with ratings between 0 to 6 ranked as detractors, 7 to 8 as passive, and 9 to 10 as promotors.

NPS uses questions such as, “How likely is it that you would recommend this company/product/service to a friend/colleague?” The NPS score is calculated by subtracting the percentage of Detractors from the percentage of promotors, leaving you with a score between -100 and 100. The higher the score, the more likely your customers will promote your business to others within their circle.

Customer Effort Score (CES)

The Customer Effort Score (CES) assesses customer loyalty. It measures how quickly customers can find what they need to purchase from your business or interact with your company. The easier it is to engage with you, the better the customer experience.

The metric helps your business understand how much effort customers put into interacting with your company and how loyal they are to your brand. A good CES score enables you to grow your reputation and understand where your business experiences pain interacting with customers. By acting based on this feedback, you can improve the overall CX and reduce the effort your people put into customer service.

Common Survey Design Pitfalls and How to Avoid Them

Good quality customer feedback is only as good as the survey design. When executed well, businesses can gain high-quality insights into their performance. However, it can be easy to fall into the trap of overcomplicating your survey or asking flawed questions. Poorly structured surveys will provide you with poor feedback upon which to make decisions, which, in all likelihood, will fail to meet your customer needs.

Here are some of the most common challenges you might meet in designing a customer feedback survey and how to overcome them:

Asking Too Many Questions

The temptation to find out as much as possible in a single survey is real. However, asking your customers too many questions is counterproductive. Customers are much more likely to interact with short, focused surveys with one or two questions rather than trawling through an endless array of questions that take too much time.

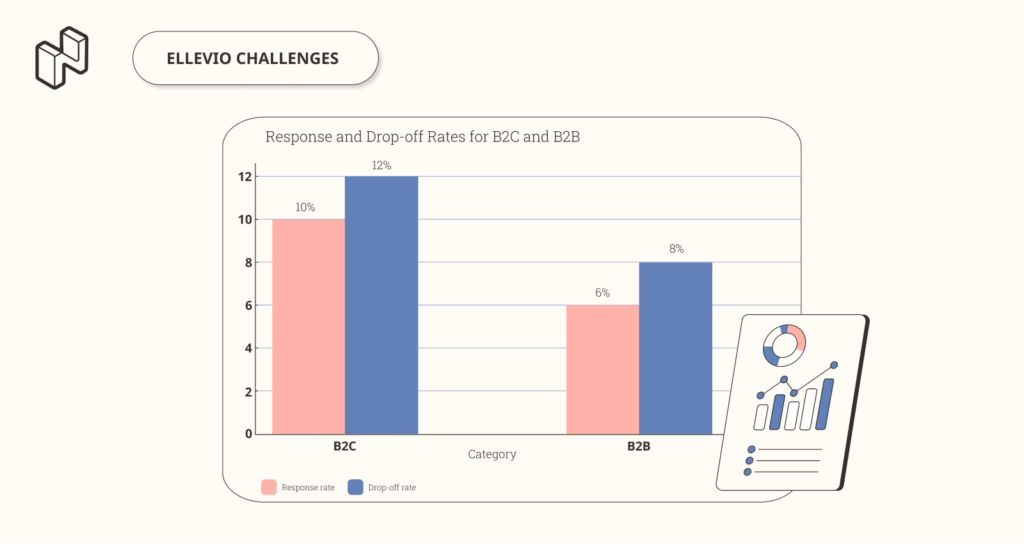

Ellevio, a Swedish energy company, encountered huge problems with two surveys designed to understand how B2C and B2B customers felt about their brand. With response rates of just 10% and 6%, respectively, they also found that 12% of B2C customers dropped off the survey on the first page, with 8% of B2B participants dropping off at the same stage.

Further investigation found that shorter surveys offer both higher response rates and better quality responses. In this case, Ellevio turned to Netigate to help improve the design and streamline their customer feedback surveys.

Keep your surveys targeted at delivering insights for one or two KPIs with minimal questions and ensure they don’t take up too much of your customers’ valuable time.

Unclear Questions/use of Jargon

While you’ll want to ask a question written professionally, avoid using complex words, phrases, or industry jargon that your average customer won’t understand. Instead, keep your questions short and simple to understand to ensure your customers aren’t confused and give incorrect answers.

Asking Leading Questions

It is easy to structure your questions in a way that might sway respondents to provide one answer over another. For instance, asking, “Are our products too expensive?” leads respondents to interpret your products as too expensive. They are more likely to agree with the question than give an independent answer.

Asking, “How would you describe our product pricing?” and offering multiple-choice answers about whether your products are too cheap, just right, or expensive will help you gain better, more transparent, and more honest insights.

Getting Started with Customer Surveys

The benefits of a well-structured customer survey are clear, and you know the most common pitfalls and how to avoid them. But where do you begin when designing your next customer feedback survey?

Set Clear Objectives

Before you decide which questions to ask your customers, understand exactly what you’re trying to ascertain. Are you looking to measure customer satisfaction, loyalty, or the number of customers who will advocate for you? Perhaps you want to learn at a more granular level and find out how successful a product launch has been or whether you’ve pitched your pricing at the right level.

Alternatively, you may already be gathering customer data and want to improve your CSAT or NPS scores to measure the effectiveness of your CX activities. Make sure you set clear objectives before creating your survey so that you can easily track your progress and measure success. For instance, you may wish to improve your NPS by 10 points. This focus helps you align your customer feedback surveys with existing business goals.

Use Customer Segmentation

No two customers are the same. Each will come to you with problems they want your services or products to resolve. Customer segmentation, which involves grouping existing and target customers based on shared characteristics, helps you reach out to the right group of people to gain more significant insights into their needs and your CX performance.

Customer segmentation helps you get to know your customers better and tailor your marketing and sales activities to maximize their benefits. In return, you can build your reputation with customers and improve brand loyalty by learning more about their interests, needs, budgets, and habits.

In addition, by understanding more about what each customer segment needs, your business can better meet their requirements and deliver beyond their expectations. For instance, continually fine-tuning your marketing message helps customers buy more as you target them with promotions and offers for products or services they need.

This personalized approach makes each customer feel understood and valued, driving more sales your way.

Ask Questions That Matter

When Netigate assisted Ellevio with streamlining their existing surveys, they offered “minimum suggestions” which were effectively essential action points that can be used as best practice. For instance, deliver the key KPI question first up to deliver the critical finding before asking follow-ups to gain greater insights.

In the case of one of Ellevio’s surveys following up with customers following a power outage, Netigate suggested condensing three questions that fed into the same metric into a single inquiry.

There were several other suggestions offered to ensure questions delivered value and insights into the metrics. Ellevio was asked to evaluate whether “I or someone else used this information to create insights or actions?” or “Do I need this information from every respondent every time?”

This process helped Ellevio understand the questions that offered insight and informed KPIs, meaning they could remove questions that didn’t need answering from the survey.

A problem with lengthy surveys is that they generally get few responses, particularly among a younger audience. Netigate gives us the opportunity to shorten the surveys and have more open-ended questions, which will trigger more responses.

Jakob Forslin, Customer Data Analyst

Designing Your Survey

Once you’ve identified your business objectives, it’s time to design your survey to gather the data to help drive actionable insights.

Best Practices for Structuring Your Survey

It’s essential always to keep your customers in mind when creating your survey to keep them engaged, maximize response rates, and gain the greatest level of insight possible. Here are some tips on how to build the most effective customer feedback surveys:

End-goal Oriented Questions

Your questions should always be created with your ultimate business goals in mind. For example, if you aim to increase customer satisfaction, your questions should be designed to gather data to help you understand how well you’re meeting that objective.

It can be easy for you to want to know more about your customers, but using questions that stray from your key customer feedback goal will disengage participants and provide you with poor-quality data.

Improve Response Rates Through Simplicity

The more responses you receive from your customer surveys, the more accurate the sentiment and data you gather. This allows you to create more targeted, actionable insights that are likely to significantly impact CX more than those produced from lower response rates and poor-quality data.

One of the best ways to ensure a high response rate is by creating simple, targeted, and short surveys that customers can fill out quickly. Keeping your surveys short and snappy makes customers more likely to engage, which means higher response rates and more insightful data.

Avoiding Bias and Priming

Avoiding bias in your questions and priming your audience to give a preferred opinion with their answers is an easy trap to fall into. For instance, you may want to understand how your customers feel about your recently launched product. Wanting a positive response is only natural, so the temptation to ask, “How amazing was your experience with our new product?” is high.

This is an example of priming your audience, hoping you will receive a positive response. While these questions might provide you with favorable answers, they’re less valuable than neutral questions, such as “How would you describe your experience with our new product?” which allows respondents to provide a fair answer that offers your business much deeper insight into how your product resonates with them emotionally.

In addition, ensure you employ symmetrical scales for respondents. For instance, if you’re measuring customer satisfaction, you should include the same number of positive and negative responses as well as a neutral one, as the example below shows:

Including more positive options than negative ones for participants to choose from is an example of introducing bias into your feedback activities, which could lead to receiving flawed results.

Optimize for Automated Insight Generation

In the past, analyzing survey responses was a manual and time-consuming task. Individuals would collate responses and use manual processes or data entry tools like Excel to understand responses and find insights.

Now that we are more digitized, businesses are turning to automated tools that not only analyze survey responses but use this data to generate actionable insights automatically.

For example, you may try to design your surveys with ChatGPT. However, we don’t fully recommend using ChatGPT alone because simply, it’s not a platform specialized for this type of job.

Solutions like Netigate can build compelling and well-structured surveys to gain maximum insight within minutes. They also allow you to gain automated analysis that translates into actionable insights to help you improve your CX initiatives.

Optimizing your surveys to enable simple, automated analysis and insight generation allows you to tailor your activities to enhance CX and deliver time and resource efficiencies, releasing employees to spend time on value-added activities.

Types of Questions to Include and When

You can include several distinct types of questions in your survey to help your customers provide you with the best quality insight. Let’s look at some of the different options:

Multiple Choice Questions

Multiple-choice questions are among the most widely used in a customer feedback survey. Giving respondents options to choose from helps make the question easy to understand and requires minimal effort from respondents to answer. This, in turn, makes the results easy to analyze.

Adding an option for “other” is a good idea as it allows respondents to answer, even if they cannot select a suitable answer from the options. This means that the data you receive is clean, as you don’t have respondents randomly choosing an answer.

Rating Questions

Rating questions have a scale of options, allowing respondents to select a number or word to represent their opinion. Both the NPS and CSAT metrics are excellent examples of rating questions, as they ask users how likely they are to recommend your business to friends and colleagues on a scale from 0 to 10 or rank their satisfaction on a scale of 1 to 5.

Another version of rating questions is Likert scale questions, which ask people to rank and choose a perception about a product or service. These questions help you understand your customers’ sentiments.

For example, you might want to capture feedback on the design of your website and offer 5 or 7 options with the same number of positive and negative options and one neutral option.

A/B Questions

A/B questions, sometimes known as closed questions, come with simple answers participants can select, such as yes or no. These questions are excellent for helping with customer segmentation and identifying customer demographics to inform your business strategy.

For instance, you can ask whether the participant plans to purchase in your industry within the next year. Depending on whether they answer yes or no can help inform your marketing strategies for those looking to make an imminent purchase and those who aren’t.

Open-ended Questions

Open-ended questions allow respondents to answer using their own words. These questions are excellent for gathering additional or more detailed insights from respondents and help you gain more meaningful insights.

However, the unstructured responses make it more challenging to analyze the answers and segment participants into the correct sections.

In Ellevio’s case, rather than asking two separate questions, Ellevio tagged an open-ended “Why?” question onto the back of a multiple-choice question, asking respondents to provide more context as to why they’d chosen a particular response. This helped respondents deliver greater insight through open-ended feedback while still streamlining the survey from 22 questions to 9, and not risking survey fatigue kicking in.

Creating Engaging Surveys

Choosing which questions to ask in your customer feedback survey is only half the job. You can select the most impactful questions possible, but no one will spend time responding to them unless your survey looks the part.

Your survey should have an appealing and user-friendly design that minimizes clicks. Take time to refine the design so that it’s mobile-friendly so that participants can respond on the go, and make sure they’re accessible to respondents who might have visual impairments.

Meanwhile, it’s essential to tailor your questions depending on your target customer segment. Each group has unique behaviors, so your questions need to reflect these. For instance, if you want to find out why certain visitors to your website don’t complete their transactions, your questions should differ from those you ask regularly returning customers about what keeps them coming back.

By tailoring your questions to meet the preferences of each customer segment to keep them engaged, you will gain in-depth insights into the behaviors of separate groups that allow you to make the best use of your customer experience activities.

Distributing your Surveys to Customers

Creating an impactful and engaging survey is useless without ensuring it reaches the right people and provides the necessary insights to elevate your CX activities. Here are some tips to maximize your customer reach and help you gather the most data possible.

Timing

Distributing your survey at the right time is critical. Send it to them when they’re likely to be most engaged with your brand and want to engage, such as immediately after they’ve made a purchase or after a positive interaction with your business.

Multi-channel Distribution

Research from Business Wire found that 40% of consumers cited multi-channel communication as the most essential feature of a company’s customer service.

With more digital channels open to businesses, expanding your audience reach and maximizing response rates has never been easier. Reach out to your customers across multiple channels like email, SMS, social media platforms, and your company’s app to gain the greatest insights.

Pros and Cons of Multi-channel Survey Distribution

| Channel | Pros | Cons |

|---|---|---|

|

|

|

| SMS Surveys |

|

|

| In-App Surveys |

|

|

Personalize invites

76% of customers today want a personalized customer experience, meaning businesses that engage with their customers individually are more likely to receive favorable responses. Personalizing invites to your customers and asking them to participate in your survey could significantly increase your response rates.

Incentives

Another excellent way of maximizing your response rate is to offer respondents an incentive. This could be a time-limited free trial of a new product, a discount on their next purchase, or a buy-one-get-one-free offer. Not only does this incentivize participants to respond to your survey, but it also helps you boost sales.

Analyzing and Acting on Survey Data

Once your data begins pouring in, you can start analyzing what your customers tell you and taking action to improve your CX activities. However, the sheer volume of data can be overwhelming, and it can be hard to know where to start.

Cleaning and Organizing Your Data

The first step is to cleanse your data, removing any duplicate or incomplete responses that might skew or introduce inconsistencies in your findings. Once you’ve got a clean dataset, you can organize it into groups and formats, making it easy to interpret and answer the questions you want answered.

Analyze the Results

Start by finding patterns, trends, and themes in the responses. This helps you understand what’s going well and uncovers potential issues that might need an immediate response. It also enables you to identify differences in behaviors or preferences between different customer segments.

The results should inform your key CX metrics, such as CSAT, NPS, customer retention rates, etc.

Create Actions

The results from your survey should inform your decision-making process. Use the results to create actionable insights through which you can meet your customer’s preferences and improve their experience with your business.

Look for areas where you can improve, tweak your offerings and services to better meet your customer’s needs, and use insights to create a more personalized experience by offering them enhanced product recommendations or exclusive offers.

Use a Customer Feedback Analysis Tool

Human analysts can manually do all the above. However, it can be time-consuming, and if the results are unfavorable, you may have lost customers by the time you’ve received actionable insights.

Tools like Netigate allow you to create insightful and engaging customer services and use the latest AI analytics technology, such as machine learning, sentiment analysis, and natural language processing (NLP), to automatically cleanse, analyze, and interpret results before providing you with detailed, focused actionable insights much faster. This allows you to quickly resolve issues and turn a customer’s negative experience into a positive one.

Conclusion

Designing customer feedback surveys that engage your audience and gain maximum insight into informing your CX activities needn’t be a time-consuming and manual task for you or your customers. Indeed, focusing on streamlining your surveys to target them at the KPI you’re measuring is likely to increase response rates, reduce the likelihood of participants dropping away, and deliver outstanding actions to elevate your CX activities to the next level.

If you want to improve and inform your CX activities, Check out Netigate’s customer feedback tool to design insightful surveys in minutes before letting its outstanding automated analytics produce impactful action points in a fraction of the time manual analytics take. This allows your CX teams to focus on what they do best, delivering outstanding customer service that boosts your brand reputation and sales.

Copyright © 2024 Netigate AB, Drottninggatan 25, 111 51, Stockholm, Sverige

Copyright © 2024 Netigate AB, Drottninggatan 25, 111 51, Stockholm, Sverige